Mad Turtle EA MT5 Setting Review – A Practical Guide for Smarter Automated Trading

Automated trading has become more than a trend-it’s a necessity for traders who want consistency without staring at charts all day. Yet many traders still struggle with one critical issue: most forex robots fail not because they are bad, but because they are used incorrectly.

This Mad Turtle EA MT5 setting review is written for traders who want clarity, not hype. Instead of repeating product specs, this guide focuses on real-world usage, common mistakes, and how traders actually set up and run this type of MT5 automated trading EA effectively.

Whether you’re new to algorithmic trading or already using MT5 robots, this article will help you understand how Mad Turtle EA MT5 fits into modern trading workflows.

➡️ More Tip & Tricks | Telegram: Join for updates, announcements, and support

➡️ Vendor Website: Available on the official product page

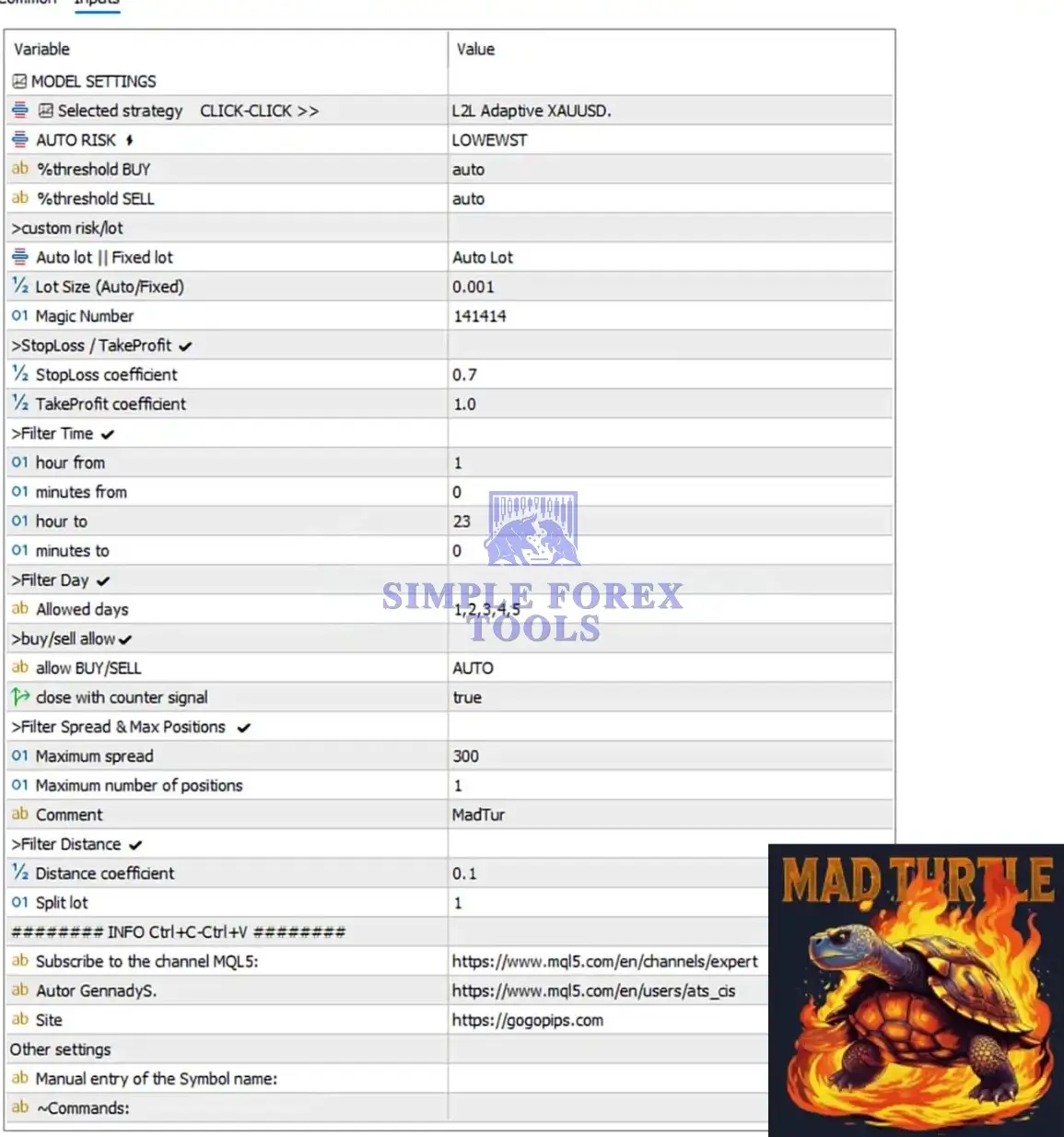

Mad Turtle EA MT5 Setting Panel

Mad Turtle EA MT5 – Download Now

The Real Challenges Traders Face with MT5 EAs

Before jumping into settings, it’s important to understand why many traders feel disappointed after installing a forex robot.

📌 Common user pain points include:

-

Over-optimized default settings that don’t match live market conditions

-

Lack of understanding of risk parameters

-

Running EAs on unsuitable currency pairs

-

Unrealistic expectations of “set and forget” trading

-

Poor VPS or broker execution quality

These challenges aren’t unique to one tool-they are industry-wide issues in automated forex trading.

Why Most Forex Robots Fail for Retail Traders

Most traders install an EA, enable auto-trading, and expect profits to appear magically. Unfortunately, that approach often leads to account drawdowns.

Typical reasons include:

-

Using one EA across all pairs without testing

-

Ignoring spread and volatility conditions

-

Setting lot sizes too aggressively

-

Not adjusting settings after market structure changes

A solid MT5 automated trading EA is only as effective as the trader’s understanding of how to configure and manage it.

How This Type of Trading Tool Solves the Problem

EAs like Mad Turtle EA MT5 are designed to remove emotional trading and apply rule-based execution. Instead of chasing trades, the system reacts to predefined market conditions.

In general, this category of tools helps by:

-

Automating entries and exits

-

Applying consistent risk logic

-

Eliminating emotional decision-making

-

Allowing traders to focus on strategy, not screen time

When configured properly, the Mad Turtle EA trading strategy approach aims to balance opportunity with controlled exposure.

📩 Free Support & Setup Help – Contact us 👉 Telegram Support

Mad Turtle EA MT5 Setup Guide (Beginner-Friendly Tutorial)

This section is written as an independent setup tutorial to help you start using the EA correctly.

Step 1: Prepare Your MT5 Platform

-

Install MetaTrader 5 from your broker

-

Log in to your trading account

-

Ensure auto-trading is enabled in MT5 settings

Tip: Always start on a demo account before going live.

Step 2: Attach the EA to a Chart

-

Open a recommended trading pair (usually major or high-liquidity pairs)

-

Use a stable timeframe such as M15 or H1

-

Drag the EA onto the chart

Make sure “Allow Algo Trading” is enabled.

Step 3: Configure Risk & Lot Settings

Instead of chasing high profits, focus on sustainability.

Best practice guidelines:

-

Use low risk per trade (0.5%-1%)

-

Avoid fixed high lot sizes on small accounts

-

Match your account balance to the EA’s logic

This step is the foundation of any successful Mad Turtle EA MT5 setup.

Step 4: Adjust Trading Session Filters

Many traders forget this step.

-

Enable trading during high-liquidity sessions

-

Avoid low-volume market hours

-

Monitor news events manually

Warning: Running EAs during major news without filters can increase drawdown.

Step 5: Test Before Going Live

-

Run the EA on demo for at least 1-2 weeks

-

Observe drawdown behavior

-

Check execution speed and spreads

Once stable, transition to a small live account.

Practical Use Cases and Real Benefits

📌This EA category is commonly used by:

-

Busy traders who can’t monitor charts daily

-

Traders looking for disciplined execution

-

Users combining manual and automated strategies

-

Traders aiming for steady, long-term account growth

📌 Key benefits include:

-

Time efficiency

-

Emotion-free trading

-

Rule-based consistency

-

Scalable account management

Mad Turtle EA MT5 Review

Mad Turtle EA MT5 has demonstrated strong performance on real trading accounts:

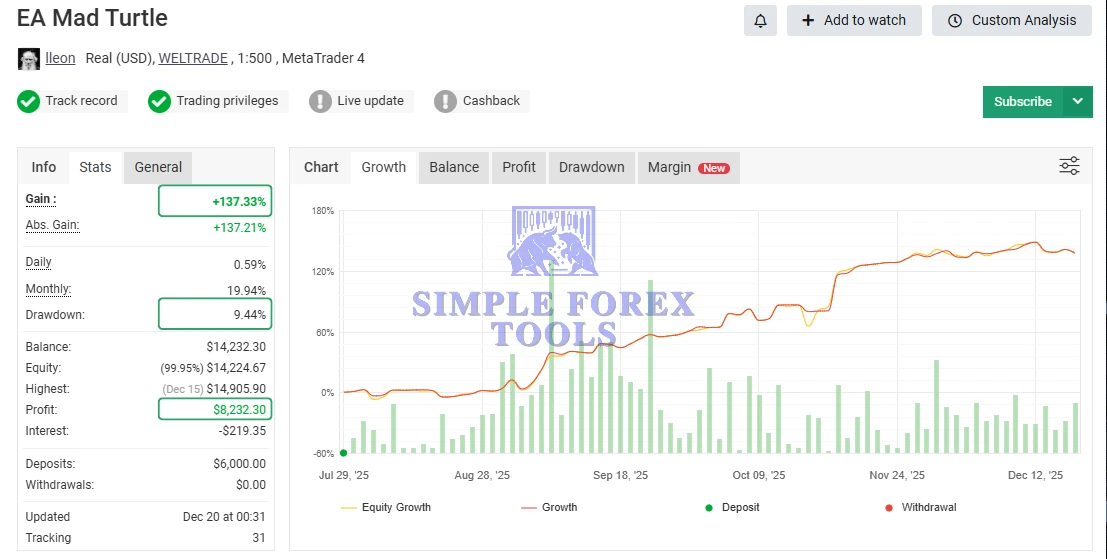

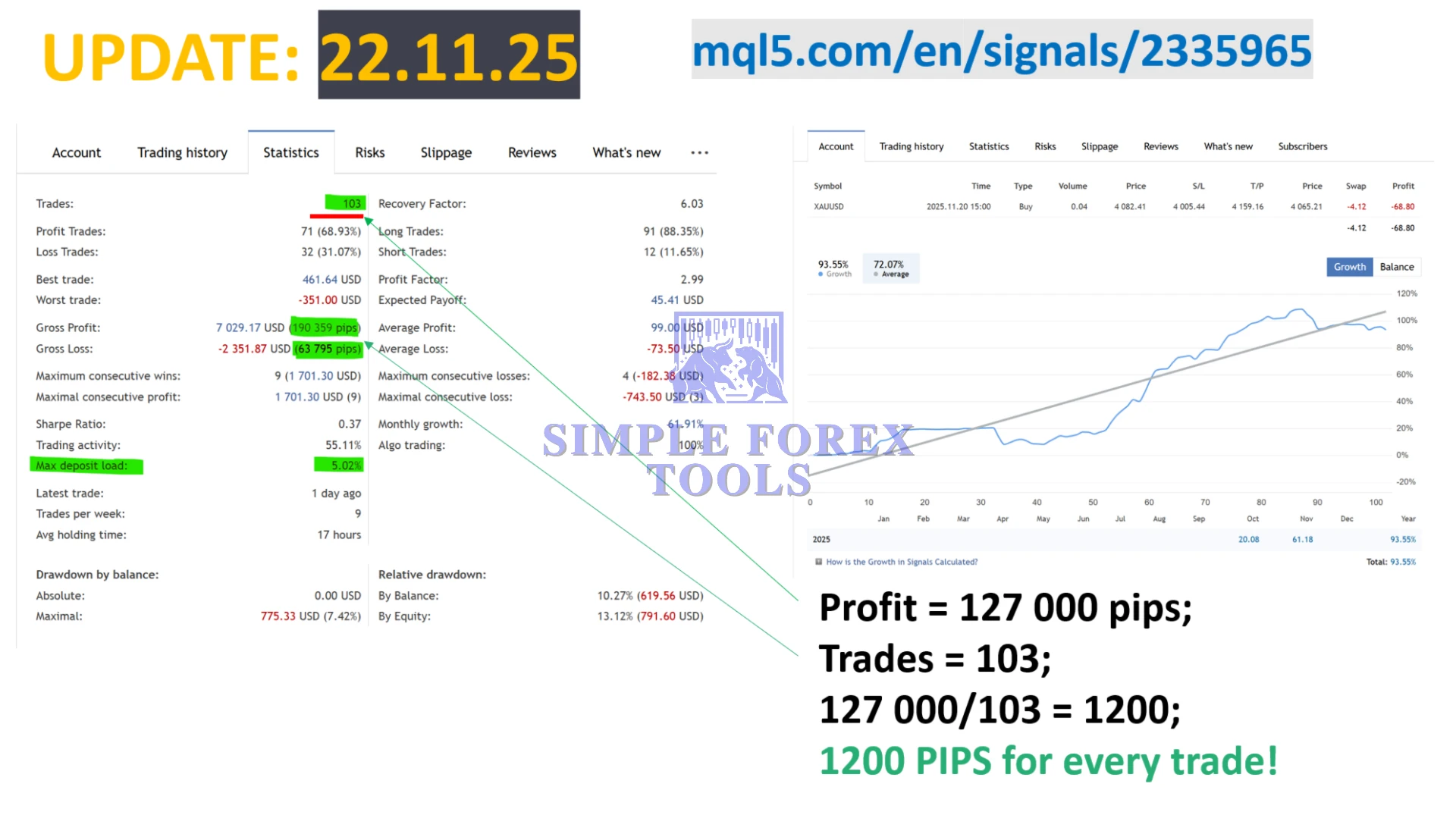

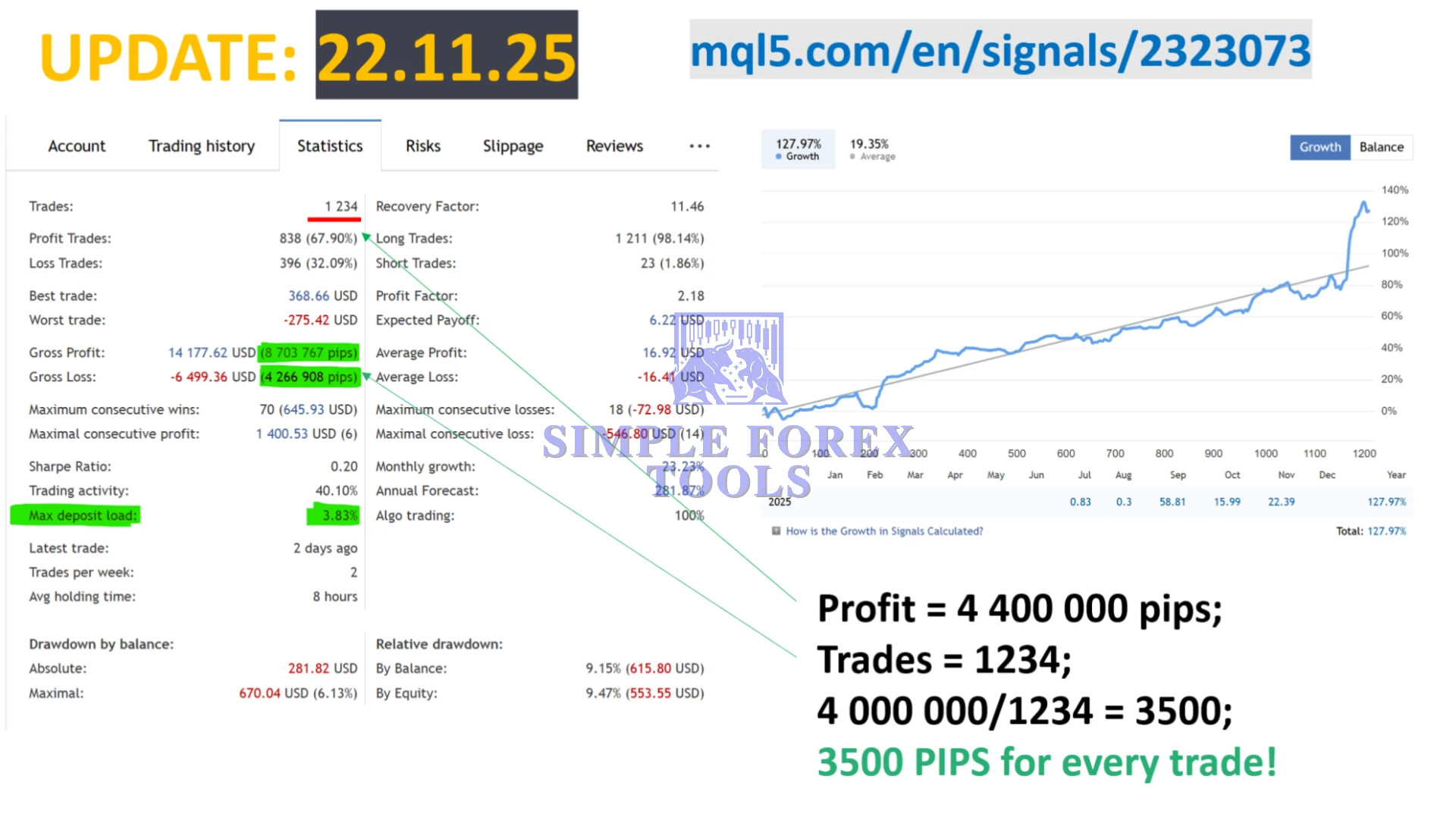

📊 Mad Turtle EA MT5 MYFXBook Live Account Results

-

Initial Deposit: $6,000

-

Gain: +137.33%

-

Maximum Drawdown: 9.44%

- Profit: $8,232.30

-

Total Trades: 103

-

Winning Trades: 71 (68.93%)

-

Losing Trades: 32 (31.07%)

-

Total Trades: 1,234

-

Winning Trades: 838 (67.90%)

-

Losing Trades: 396 (32.09%)

Best Practices for Long-Term Results

To get the most out of this forex robot MT5 settings approach, follow these tips:

-

Use a reliable VPS for 24/5 operation

-

Avoid changing settings too frequently

-

Monitor performance weekly, not hourly

-

Keep realistic expectations

-

Diversify risk across strategies, not just pairs

Common mistake: Increasing lot size after a winning streak-this often leads to losses.

FAQs – Traders Also Ask

📌 Is Mad Turtle EA MT5 suitable for beginners?

Yes, when started on a demo account and used with conservative risk settings.

📌 Can I use Mad Turtle EA MT5 on multiple pairs?

It’s better to start with one or two pairs and expand after testing.

📌 Does this EA require manual intervention?

Minimal, but periodic monitoring is recommended.

📌 Is VPS mandatory?

Not mandatory, but highly recommended for stable execution.

Final Call to Action

If you want disciplined automation without emotional trading-and prefer a structured Mad Turtle EA MT5 setting review instead of marketing hype-this tool is worth serious consideration.

🔗 Check the official Mad Turtle EA MT5 page here and start with confidence.