FortiFx Master CL MT4 EA Settings Review – A Practical Setup Guide for Real Traders

Automated forex trading has exploded in popularity, but many traders still struggle to get consistent results. The biggest issue isn’t the strategy itself-it’s incorrect setup, unrealistic expectations, and poor risk control. This is where most traders fail before they even give an Expert Advisor (EA) a fair chance.

In this FortiFx Master CL MT4 EA settings review, we’ll break down how traders can properly set up and use this type of automated system, what problems it’s designed to solve, and how to avoid the most common mistakes that lead to blown accounts.

This is not sales copy. This is a practical, experience-based guide written for traders who want clarity before deploying an EA on MetaTrader 4.

➡️ More Tip & Tricks | Telegram: Join for updates, announcements, and support

The Real Challenges Traders Face With Automated Forex Trading

Before using any MT4 forex EA, traders usually face the same set of problems:

-

Emotional overtrading after losses

-

Inconsistent manual entries

-

Lack of discipline during volatile sessions

-

Poor risk-to-reward execution

-

Confusion around EA settings and optimization

Many traders buy an EA, attach it to a chart, and expect instant profits. When results don’t match expectations, they blame the tool-when in reality, the issue is incorrect configuration and misunderstanding how automated forex trading MT4 systems actually work.

Why Most Forex EAs Fail for Retail Traders

After analyzing discussions from global trading forums, Reddit threads, and top-ranking EA review blogs, one pattern stands out:

Most EAs fail because users misuse them.

Common reasons include:

-

Running default settings on unsuitable pairs

-

Ignoring account size vs lot sizing logic

-

Using EAs during high-impact news

-

Running multiple EAs without margin planning

-

Treating automation as “set and forget”

This is why understanding the FortiFx Master CL EA strategy and its settings is more important than the EA itself.

How This Type of MT4 EA Helps Solve the Problem

Tools like FortiFx Master CL MT4 EA are designed to bring structure and discipline into trading. Instead of emotional entries, the system follows predefined logic to:

-

Identify structured market opportunities

-

Execute trades without hesitation

-

Manage entries and exits systematically

-

Reduce emotional decision-making

When used correctly, this category of EA can help traders maintain consistency-especially those who struggle with manual execution.

FortiFx Master CL MT4 EA – Dawnload Now

FortiFx Master CL MT4 EA Settings – Step-by-Step Setup Guide

This is a beginner-friendly, independent setup guide based on real MT4 usage.

📌 Step 1: Prepare Your MT4 Platform

-

Install MetaTrader 4 from your broker

-

Log in to your trading account

-

Ensure auto trading is enabled

-

Allow DLL imports in MT4 settings

Tip: Always test on a demo account first.

📌 Step 2: Attach the EA to the Correct Chart

-

Open a single chart in MT4

-

Use the recommended timeframe (commonly H1 or H4 for stability)

-

Attach the EA to one chart only

Avoid attaching it to multiple charts unless you fully understand margin impact.

📌 Step 3: Adjust Risk and Lot Size Settings

This is the most critical part of the FortiFx Master CL MT4 EA settings.

Best practice:

-

Use low fixed lot size for small accounts

-

Risk no more than 1–2% per trade

-

Avoid aggressive multiplier settings

Warning: Overleveraging is the fastest way to destroy EA performance.

📌 Step 4: Trading Session & Market Conditions

-

Avoid running the EA during major news events

-

Best performance often occurs during stable market sessions

-

Use a VPS for uninterrupted execution

This dramatically improves automated forex trading MT4 stability.

📌 Step 5: Monitor & Optimize Gradually

-

Review trades weekly

-

Avoid changing settings daily

-

Track drawdown, not just profits

EA trading is about consistency, not chasing quick wins.

📩 Free Support & Setup Help – Contact us 👉 Telegram Support

Practical Use Cases & Benefits

From real-world usage scenarios, traders often use this type of EA for:

-

Semi-passive trading alongside a day job

-

Reducing emotional trading errors

-

Supporting manual strategies with automation

-

Long-term account growth with controlled risk

Key benefits include:

-

Structured execution

-

Time-saving automation

-

Reduced psychological pressure

-

Strategy consistency

This is why FortiFx Master CL EA review searches are increasing globally.

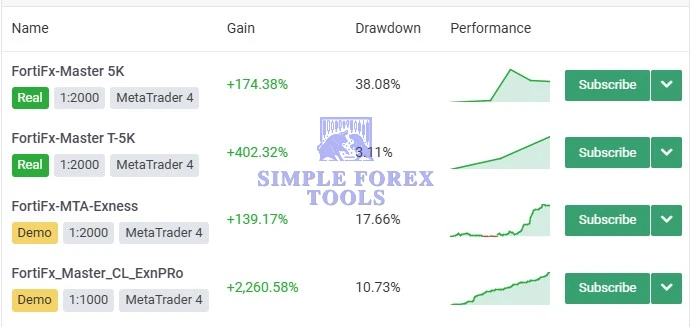

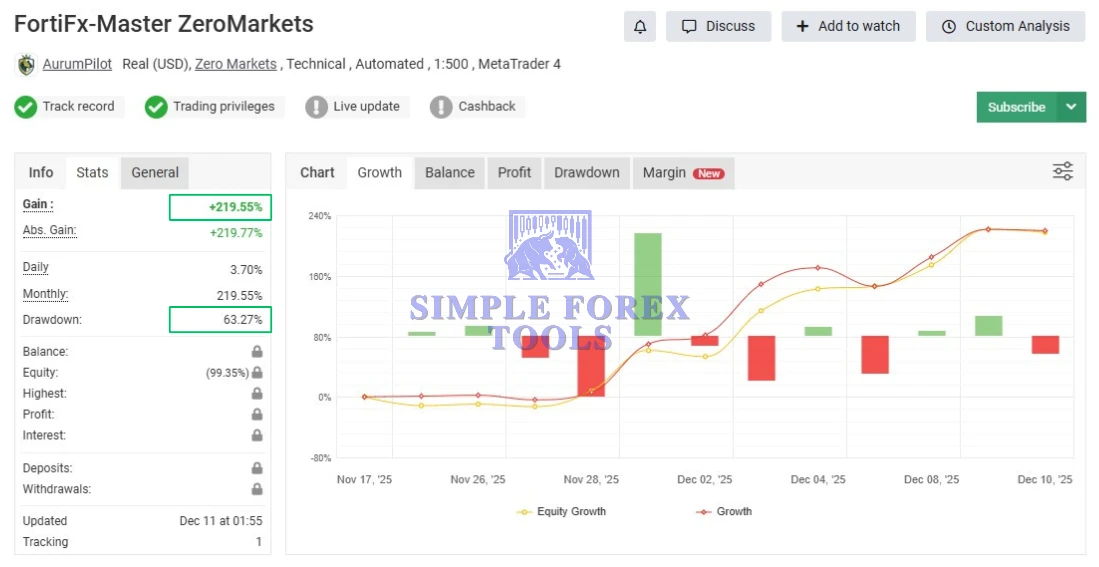

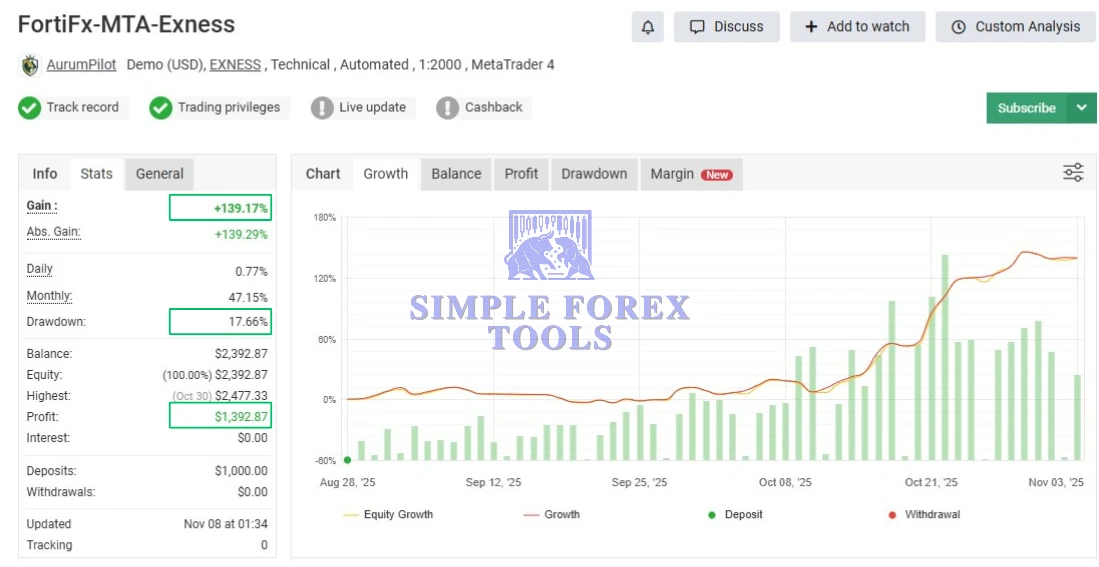

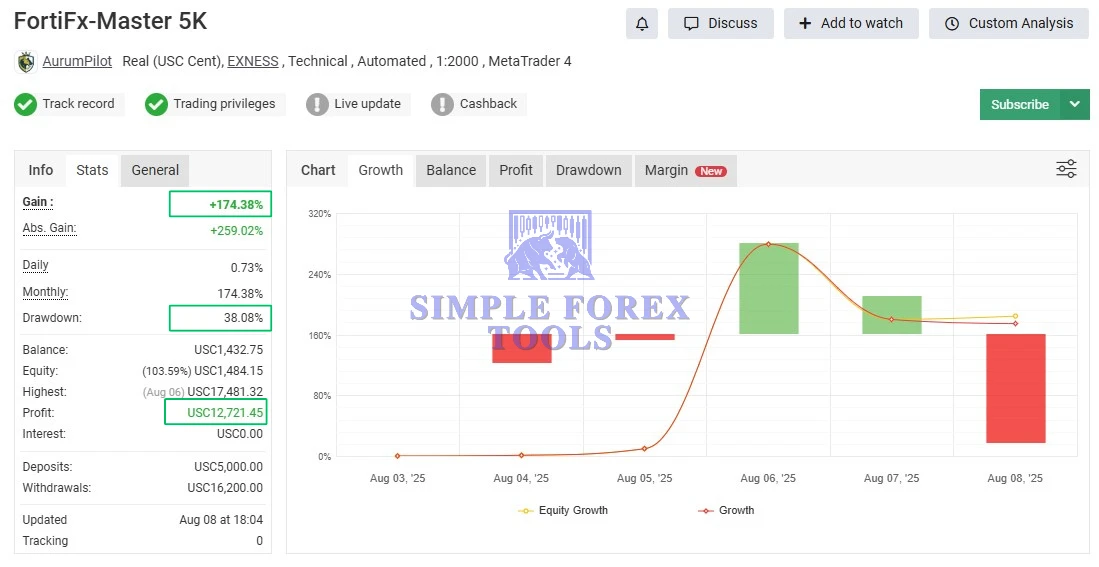

FortiFx Master CL MT4 EA Review

Best Practices for Long-Term Results

To get the most from FortiFx Master CL MT4 EA settings:

-

Start small and scale gradually

-

Use a reliable broker with low spreads

-

Combine EA trading with basic market awareness

-

Never run an EA during extreme volatility blindly

Common mistake: Treating EAs like gambling tools instead of trading systems.

Frequently Asked Questions (FAQs)

📌 Is FortiFx Master CL MT4 EA suitable for beginners? Yes, but only if beginners follow proper risk management and use a demo account first.

📌 Can I run it on a small account? Yes, with correct lot sizing and conservative settings.

📌 Does it work on all currency pairs? Most traders focus on major pairs. Testing is essential before expanding.

📌 Do I need VPS hosting? Not mandatory, but strongly recommended for stable execution.

Final Thoughts – Is It Worth Using?

If you understand that no EA is a magic button, tools like FortiFx Master CL MT4 EA can become a valuable part of a disciplined trading plan. The real edge comes from how you set it up and manage it, not just owning the EA.

If you want to explore the official product details, supported brokers, and licensing information, you can check the product page through our trusted FortiFx Master CL MT4 EA resource link and decide if it fits your trading goals.

Smart traders don’t chase hype-they build systems.